By Brett Undershute

Why are US dollars so expensive in Canada?

There are a number of everyday things we Canadians buy that simply costs extra here. When I buy a book in Canada, I like to ask if I can pay the U.S. price listed on the book jacket. (It has not worked yet, but I try.) I don’t spend a lot of money on books; what I was spending a lot of money on was foreign exchange fees.

Overall, the banks in Canada provide us with great service on a number of financial products, savings accounts, chequing accounts, the ability to email transfer money, brokerage accounts, and I love to collect those credit cards points. Even the bank machines have improved recently.

But when it comes to foreign exchange fees, the banks still think it is 1989, not 2019. I am writing this from my home office, from which advances in technology allow me to trade directly in the foreign exchange market, using this thing called the Internet.

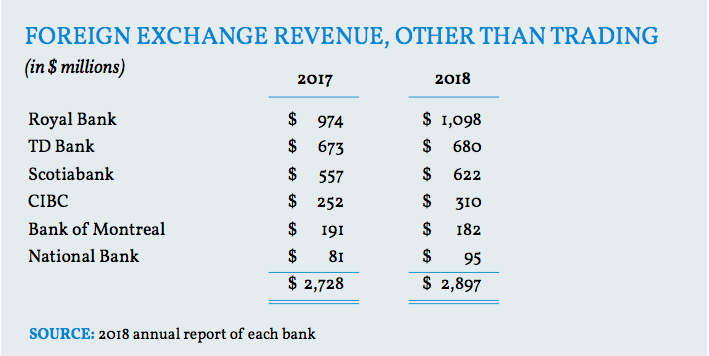

To give you a sense of how profitable the foreign exchange fees are for the banks, consider the following table. In 2018, the banks increased foreign exchange revenue 9.5%. Royal Bank itself topped the $1-billion mark. Combined, they made nearly $3 billion.

A couple pieces of advice: If you are changing money at your bank, ask for both the rate to buy U.S. dollars and sell them, so you know how much you are paying. Your bank won’t tell you this, but sometimes you can improve the rate just by asking. A better idea is to give me a call. I will give you a great rate and tell you my fee.

Brett Undershute is president of Mt. Brisemia Capital Corp., a company he founded in 2017 to help Canadians save money on their foreign exchange transactions. Prior to launching Mt. Brisemia, Undershute, who earned an MBA from the Ivey Business School, spent 18 years in the financial services industry followed by three years in the oil and gas industry.