by Miklos A. Nagy

Business Edge Media

Starting in the early 1990s, the financial advisory business began to snowball, fueled by the savings of baby boomers and an explosion of new financial products. Advisers entering the career back then have now been at it for 30 years and thinking about succession plans and retirement. For the younger advisers, this represents an avenue for getting to the next level. With books of business coming up for sale, what do you pay and how does one structure a buyout?

As a potential selling adviser, you should be focusing on maximizing the value of your practice. The timing of your retirement needs to be taken into consideration as the supply of practices coming onto the markets will be increasing over the next decade. This will be especially important if you have a niche business and don’t want it to be absorbed by a one-size-fits-all conglomerate.

According to Investment Executive's August 24, 2018, issue, “In fact, the results of this year’s Report Card series, compared with those from 2009, revealed just how much things have changed since. For example, the average age of advisers surveyed this year was 50.4 years, up from 46.7 in 2009, while the percentage of advisers who have a documented succession plan in place increased even more acutely, to 46.7% in 2018 from 27.3% in 2009.” You can read the whole article by clicking in the following link: https://is.gd/agingadvisors

At present, the most common price for a mutual fund book is 2 to 3 times annual trailers fees. Using an average figure for the assets under management (AUM) of $50 million and a mix of DSC and front-end funds, this book may be worth $500,000 to $1.5 million before any retention adjustments.

The actual price that you will get is dependent on the quality of the clients, average asset size and distribution, geographic distribution and motivation to sell. The purchase price is typically paid over 2 or 3 years. The purchase is generally structured as an asset sale. Consequently, you will be paying close to the maximum marginal tax rate; around 50% (except in AB where that would be approximately 45%). Assuming a 95% asset retention on the sale of your mutual fund book of business, this translates to you receiving, after-tax, somewhere between $250,000 and $750,000 (slightly more in Alberta). Although this amount is substantial, it will undoubtedly result in drastically reduced spending habits for you, unless you have previously accumulated significant other assets for your retirement.

Despite the above facts, if you are one of the advisers without a succession plan, there could be lucrative alternative opportunities for you. One is referring your book of business to a portfolio manager and eventually contractually selling it over time for potentially significantly more money.

Many professional portfolio managers are seeking to increase their AUM. They usually charge 1.50% to 2.25% to manage portfolios, including mutual fund trailer fees, if any. The referred mutual fund portfolio may be kept in mutual funds, or be converted to managed stock and bond portfolios or the combination of these two.

Depending on the quality of your business, you could enter into a contractual referral agreement with a portfolio management firm. For referring your entire book of business, the portfolio manager would likely compensate you with an annual fee of 1% calculated on the total asset you referred to them. Also, you could receive the same 1% annual referral fee on any new assets that your former clients refer to them plus any new business you refer to them in the future. The term “referred assets” in this context is defined as the entire book of business you initially referred, any new assets that your former clients refer to them in the future and any new assets you are going to refer to the portfolio manager. The referred assets are an ever-changing number that will fluctuate in value according to first and foremost the performance of the portfolio manager on the entire referred assets, retention of clientele and the new assets that you and your former clients refer to them in the years to come.

The arrangement could be open-ended or could stipulate that the portfolio manager is obligated to buy the referred business at a set date in the future for a price based on a specific formula. If the referring arrangement contains a purchase clause, the buyout typically happens three to five years out, and the purchase price generally is between 2.5% and 3% of the referred assets at the same point.

This kind of arrangement will eliminate your costs and expenses associated with your business and free up a lot of time for you. You will still be engaged to get more referrals to the portfolio manager acting as a relationship manager. You won’t be subject to the ever-increasing regulatory/compliance risk.

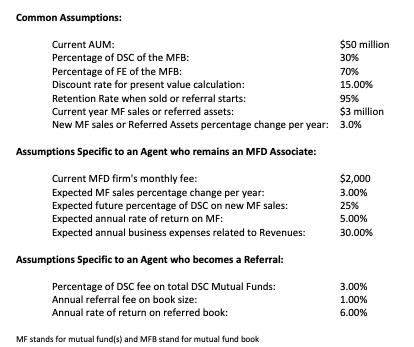

Below I illustrate the difference in income between the cases of remaining a financial adviser versus becoming a referral agent to a portfolio manager by a former adviser with the following assumption:

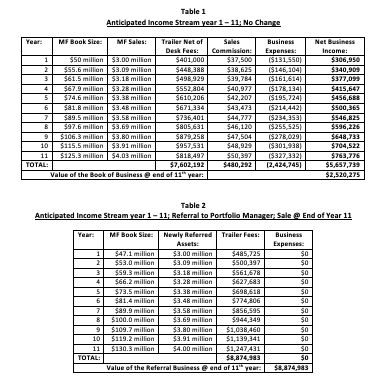

Below, I illustrate the three cases: Table 1 assumes you continue to be a mutual fund adviser and show the net income stream for the next 11 years with a range of expected sale price at the end of the period and Table 2 assumes that you become a referral with an open-ended referral arrangement showing the net income stream and the expected sale price at the end of the period (11th year). Table 1 also shows the estimated value of the business at the end of the 11th year, assuming the MFDA industry’s most common calculation of purchase price of 2.5 times the average of the last three-year net income formula adjusted to retention. Table 2 shows the value of the business at the end of year 11 using the 3x referral fees formula used by certain portfolio managers.

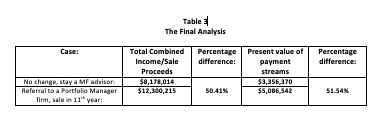

To show the differences in among the three above scenarios I calculated the present value of all income including sales proceeds from your book/referred book. The discount rate I used is 15% per annum. Table 3 shows the final analysis:

The benefit of a referral arrangement is not negligible by showing more than 50% more income compared to staying a financial adviser registered through the MFDA. This difference is even higher considering that instead of working full-time you only would work part-time as a referrer to the portfolio manager

There are many permutations on the referral arrangement that you, as a mutual fund advisor, could make with a respectable portfolio management firm. If you are age 60 or older, you should look at these possibilities carefully to maximize your payout and do this earlier than later as the supply of mutual fund advisers seeking any one of the above exit strategies are expected to substantially increase in the coming years, potentially resulting in lower payout arrangements for you.

If you are an MFDA financial adviser and thinking about retiring and selling or referring your book of business, Fin-Plan can help you. To ask any question about this article or to book an appointment to look at your particular case, contact Miklos at nagy@fin-plan.ca. Miklos is a book of business broker, fee-only financial planner, best-selling author, finance-related educational course writer, statistician and former Chair of the Canadian Institute of Financial Planners. His Mutual Fund Book Brokering and Fee-Only financial planning website is at www.fin-plan.ca and his Linkedin page is at https://is.gd/bookofbusinessbroker.

The views expressed in this material are the opinions of Miklos A. Nagy through the period ended June 16, 2020, and are subject to change based on market and/or other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investing involves risk, including the risk of loss of principal. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other non-commercial uses permitted by copyright law. For permission requests, write to Miklos at nagy@fin-plan.ca.