August 11, 2023 – St. Albert, Alberta – Enterprise Group, Inc. (TSX: E) (the “Company” or “Enterprise”). Enterprise, a consolidator of energy services (including specialized equipment rental to the energy/resource sector), emphasizing technologies that mitigate, reduce, or eliminate CO2 and Greenhouse Gas emissions for small to Tier One resource clients, is pleased to announce its Q2 2023 results.

- Identified and defined under “Non-IFRS Measures”.

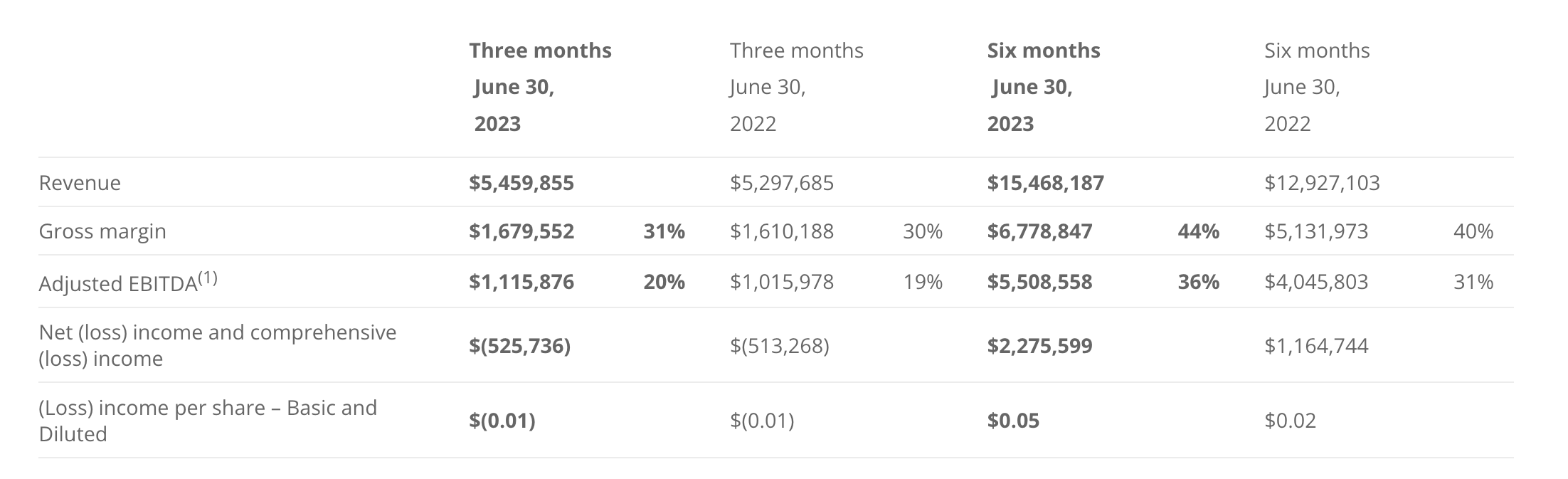

- The first six months of the year was one of the strongest in recent history. The second quarter of 2023 equalled the prior year results despite returning to its typical seasonal slowdown of spring breakup and road bans. In the previous year, instead of slowing down in Q2, the industry worked through and retooled in Q3 of 2022. The second quarter of 2023 also had the challenge of forest fires in Northern Alberta and British Columbia, which resulted in mandatory evacuation orders and workplace shutdowns, reducing activity in the affected areas and supressing the quarterly results. Revenue for the three months ended June 30, 2023, was $5,459,855 compared to $5,297,685 in the prior period, an increase of $162,170 or 3%. Gross margin for the three months ended June 30, 2023, was $1,679,552 compared to $1,610,188 in the prior period, an increase of $69,364 or 4%. Adjusted EBITDA for the three months ended June 30, 2023, was $1,115,876 compared to $1,015,978 in the prior period, an increase of $99,898 or 10%. Revenue for the six months ended June 30, 2023, was $15,468,187 compared to $12,927,103 in the prior period, an increase of $2,541,084 or 20%. Gross margin for the six months ended June 30, 2023, was $6,778,847 compared to $5,131,973 in the prior period, an increase of $1,646,874 or 32%. Adjusted EBITDA for the six months ended June 30, 2023, was $5,508,558 compared to $4,045,803 in the prior period, an increase of $1,462,755 or 36%. Increases in revenue, gross margin and EBITDA for the three and six months, are reflective of increases customer activity in 2023 while maintaining the operating efficiencies of the Company.

- For the six months ended June 30, 2023, the company generated cash flow from operations of $8,517,478 compared to $4,841,629 in the prior period. This change is consistent with the higher activity levels during the period. The Company continues to utilize a combination of cash flow and debt to right-size and modernize its equipment fleet to meet customer demands. During the six months ended June 30, 2023, the Company purchased $6,945,205 of capital assets, primarily for natural gas power generation, upgrading the energy efficiency of existing equipment and meeting specific requests from customers. The Company continues to see its customers switching to natural gas as a cleaner and more efficient alternative to diesel, increasing the demand for natural gas generators and micro-grid packages.

- During the six months ended June 30, 2023, the Company repurchased and cancelled 1,271,000 shares at a cost of $508,784, or $0.40 per share. These shares had a carrying value of $1.32 per share for a total of $1,162,830 which has been removed from the share capital account. Since the initiation of the share buyback program, the Company has purchased and cancelled 11,328,500 shares at a cost of $2,900,364 or $0.26 per share. These shares have a carrying value of $1.41 per share for a total of $15,960,766 which has been removed from the share capital account over the entire share buyback program. Enterprise has effectively bought back and cancelled the maximum amount of shares allowed under its current share buy back program. Management is in the process of renewing the program and will continue to be aggressive in acquiring its shares as they believe its stock remains undervalued as the Company’s book value is $0.74 per share. Additionally, the Company has available tax losses of $0.16 per share and is in the process of developing a consolidated tax plan to utilize those losses.

- In April of 2022, Enterprise Group officially launched a new wholly owned subsidiary, Evolution Power Projects, Inc. EPP is the leading provider of low emission, mobile power systems and associated surface infrastructure to the Energy, Resource, and Industrial sectors. The Company’s innovative methods are delivering to its client’s low emission natural gas-powered systems and micro-grid technology, allowing clients to eliminate diesel entirely. A significant portion of Enterprise’s capital expenditures for 2022 and 2023 was for additional natural gas-powered systems, including turbine generators. EPP can now provide multi-megawatt mobile micro-grid technology which has allowed EPP to expand its services into water pumping and drilling support, further eliminating the use of diesel power. Also, EPP’s systems are equipped to deliver real-time emission metrics providing its clients the assurances necessary for them to accomplish their ESG reporting and objectives.

- On January 23, 2023, the Company’s common shares began trading on the OTCQB Venture Market under the ticker symbol ETOLF. In addition to the listing, Enterprise’s shares are now eligible for electronic clearing and settlement with the Depository Trust Company for trading in the United States. This listing will help to increase Enterprise’s visibility and accessibility to a growing audience of U.S. investors.