By Miklos A. Nagy

Business Edge Media

I wrote my first article about the “Smith Manoeuvre” in November, 2019. Since then, the world has been grappling with the COVID-19 pandemic with significant implications for every country’s economy and future.

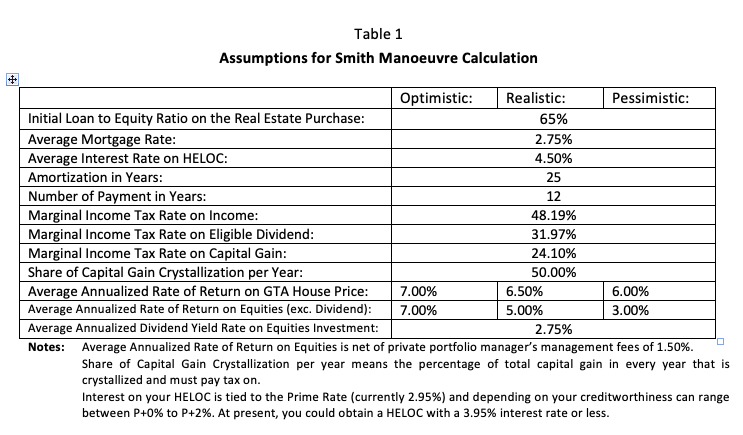

In this article, I present the updated calculation for the Smith Manoeuvre using the marginal 2020 tax rates and assumptions based on my findings for the average long-term rate of return for equities and home prices in the Greater Toronto Area (GTA).

The Smith Manoeuvre is a relatively simple concept. The idea is to convert a mortgage to an investment loan over time and in so doing transform your non-tax-deductible mortgage interest payments to tax-deductible investment loan interest payments.

To implement this strategy, you need a re-advanceable mortgage, consisting of your regular traditional mortgage and a home equity line of credit (HELOC). At any point in time, the sum of the remaining balance of your mortgage and the limit of your HELOC is constant, typically 60-65% of your home’s value at the start. In other words, this arrangement allows your HELOC’s limit to be a certain percentage of your home’s value, in the beginning, less the current mortgage balance on your property. As you make mortgage payments, the principal is paid down on your mortgage. Your HELOC’s limit will be increased by the same amount of principal you are paying off at each mortgage payment. The strategy is to invest these increases in your HELOC in dividend and/or interest-earning investments, thereby making the interest payments on your HELOC tax-deductible.

By doing this repeatedly until your mortgage is paid off, you will eventually fully convert your non-tax-deductible mortgage interest payments to tax-deductible interest payments on your HELOC. For this strategy to work, you need to invest in instruments that have a reasonable expectation of earning interest or dividend income. If you invest to make capital gains and no interest or dividends, your interest payments would not be tax-deductible. The investments can be managed portfolios invested in stocks that will pay you a dividend, dividend-paying mutual funds, income-producing rental properties or private first, second or third mortgages.

With the Smith Manoeuvre, you will be able to pay off your mortgage much sooner and could build substantial net equity on top of the value of your initially mortgaged property at the end of the original mortgage term (usually 25 or 30 years).

Based on my findings published in my blogs: “What is a Realistic Return Expectation in Equity Investing” http://fin-plan.ca/what-is-a-realistic-return-expectation-in-equity-investing (August 31, 2019) and in “The COVID-19 Virus’ likely Effect on Investing” http://fin-plan.ca//the-covid-19-virus’-likely-effect-on-investing (April 20, 2020). For a realistic long-term projection on the effect of the Smith Manoeuvre, I used the following assumptions for the next 25 years for the following variables for my projections:

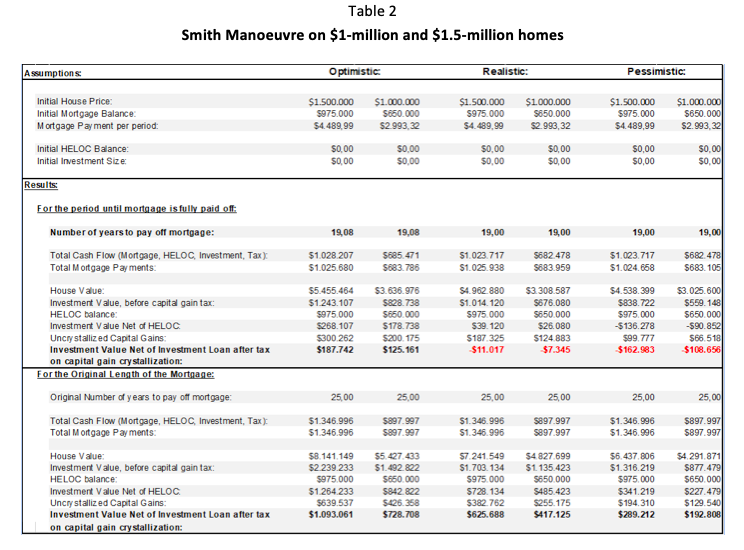

There are several variations of the Smith Manoeuvre. The main, and in my opinion, the best strategy to follow is to use the tax refunds and dividend payments to reduce your mortgage principal. Then reborrow, using your HELOC, the total of these principal reductions. These principal reductions will reduce your mortgage balance in excess of your regular monthly mortgage principal reductions attributed to your regular mortgage payments. If the tax refunds turn into tax payables, due to crystallization on capital gains and dividend taxes, use your dividend payments to the extent that your cash flow will not increase beyond the original monthly mortgage payments calculated on the length of the amortization period (either 20 or 25 years). Following this strategy, the effect of the Smith Manoeuvre on your future net worth can be substantial as Table 2. demonstrates. Based on averages calculated over almost the past 60 years in a “realistic” scenario, the positive effect of the Smith Manoeuvre could amount to $626,000 and $417,000 in cases applying the Manoeuvre to $1.5-million and $1-million homes, respectively.

Also as shown in the “Optimistic” scenario, employing the Smith Manoeuvre could make you close to $1,100,000 richer over a 25-year period, assuming that you convert over time your initial mortgage of 65% ($975,000) of the current home value ($1.5 million) to tax-deductible interest on your HELOC. The exact amount of how much you will benefit from this strategy is dependent on several factors. Keep in mind that your benefit could be significantly less should interest rates substantially rise or stocks perform considerably poorer than historical norms. But benefit could also be more. Contact Fin-Plan for a full set of the assumptions related to the above table.

The figures in Table 2 are based on investing in dividend-paying Canadian equities. You could also invest in dividend-paying U.S. equities or in first, second and third private mortgages instead of equities, or a combination of all of these. In the long term, U.S. equities outperformed Canadian equities by a large enough margin to consider them as potential investments implementing the Smith Manoeuvre. This is despite the less-favourable tax treatment on U.S. dividends and the foreign-exchange risk associated with these investments.

Currently, investing in first, second and third private mortgages could give you a yield of 6-14%. These yields are high enough that, despite the fact that interest income is being taxed at the highest rate and without any ability to defer taxes on any portion of them, they could also be considered options. I will analyse the Smith Manoeuvre's performance assuming investment in U.S. dividend-paying equities and/or Canadian mortgages instead of Canadian dividend equities in one or more of my articles.

Your gain (or loss) from the Smith Manoeuvre is dependent on your mortgage rate, HELOC interest rate, rate of return on your investments excluding dividends, and dividend yield or interest.

The drawback of this strategy is that your overall debt level will stay the same and, therefore, you will generally carry a higher level of risk. This increased risk is mitigated by the fact that instead of relying on real estate prices to increase, your portfolio will be diversified into a mix of real estate and equity investments. Keep in mind that regardless of the Canadian real estate price boom in the past 25 years, especially in the GTA and Vancouver, there is a risk of significantly lower growth rates in real estate for the next decades. Toronto and Vancouver have been consistently in the 10 most expensive cities in the world.

In my blog “The COVID-19 Virus’s likely Effect on Investing” http://fin-plan.ca//the-covid-19-virus’-likely-effect-on-investing I analysed how different asset classes historically performed in inflationary periods since 1961. Due to the enormous amount of “printed” money that is being pumped into the major economies, I see high likelihood of higher inflationary periods in the coming years. My finding is that in inflationary periods, real estate investment has done quite well while equities do not keep up with inflation nearly as well and mid- and long-term bonds do quite poorly.

In view of these findings, it is justifiable for investors to increase their real estate investment (at least in the Toronto and Vancouver regions). If so, I think the best way to boost your real estate exposure is to buy a more expensive principal residence and follow the Smith Manoeuvre to maximize your long-term net worth.

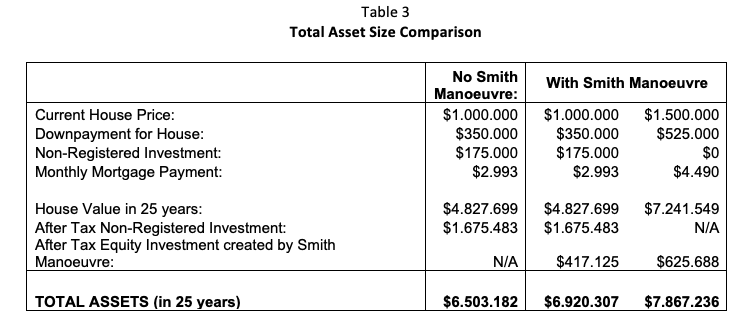

To illustrate this strategy, consider the case of a couple that wants to purchase a $1-million home in the GTA and has up to $525,000 for downpayment. Suppose that they have substantial additional non-registered and registered investments. Now compare this strategy to the one for them to buy a $1.5-million principal residence instead. Table 3 depicts the result of the three strategies:

- Buy a $1-million principal residence and do not implement the Smith Manoeuvre

- Buy a $1-million principal residence and implement the Smith Manoeuvre

- Buy a $1.5-million principal residence and implement the Smith Manoeuvre

Given the set of assumptions set out previously, your total after-tax, non-registered investment will increase by 25% by applying the Smith Manoeuvre on your $1-million house. The total after-tax net worth would be increased by 21% should you opt to buy a $1.5-million home and implement the Smith Manoeuvre compared to purchasing a $1-million home without embarking on the Manoeuvre. The calculation of the value of the non-registered investment in 25 years assumes that the differential in mortgage payments ($1,497 per month) is added to your non-registered investment.

Fin-Plan can help you with advice on whether to implement the Smith Manouevre and can help implement this potentially useful strategy. Contact Miklos Nagy at nagy@fin-plan.ca with any questions about this article or to book an appointment to look at your particular case. Miklos is a fee-only financial planner, best-selling author, finance-related educational course writer, statistician and former Chair of the Canadian Institute of Financial Planners with more than 25 years of experience in financial planning for high net-worth and middle-class Canadians. His fee-only financial planning website is www.fin-plan.ca and his Linkedin page is https://www.linkedin.com/in/miklos-nagy-fee-only-financial-planner.

Copyright © 2020 by: Miklos A. Nagy

The views expressed in this material are the opinions of Miklos A. Nagy through the period ended May 15, 2020, and are subject to change based on market and/or other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investing involves risk, including the risk of loss of principal. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law. For permission requests, write to Miklos at

nagy@fin-plan.ca.